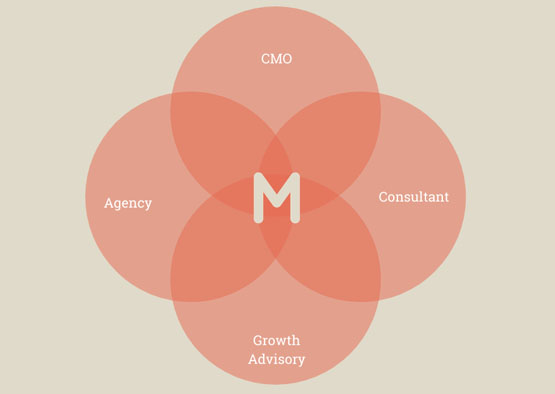

We offer strategic marketing support for ambitious startups in exchange for equity. We have the skills and experience to help you reach your customers and access your next round of funding. Let’s make something great, together.

Is exchanging equity for marketing services right for your business?

Exchanging equity for services, marketing or otherwise, isn’t right for every business or indeed for every Founder. There are a number of factors that need to be considered when deciding whether exchanging equity for marketing is the best strategy for your startup.

We can help you to navigate this decision making process, where we would consider the following:

Have you been through a funding round / valuation?

This isn’t essential for early-stage businesses but does help when agreeing terms. What’s important is finding a remuneration structure that make sense for you (a convertible note may help it’s technically debt finance, not equity, meaning a valuation at this point isn’t necessary).

Who are the current shareholders?

It’s important that everyone understands who is involved in decision making and at what stages. Everyone should be on the same page and working towards the same goal.

Is your business in a position (operationally) to scale?

If you have the product/service, we can help you reach the right audience if you’re in a position to scale. If you’re not quite ready to scale rapidly, we can help there too through access to finance or operational support.

When do you forecast generating revenue?

An equity exchange should be a mid-long term partnership. You’ll need a solid understanding of when you expect to generate revenue and ultimately when you foresee the business becoming profitable.

What is your exit strategy?

Equity exchange isn’t right for a lifestyle business. Investors, including those investing their time or expertise, will have their own expectations in terms of an investment horizon and will expect a planned roadmap to exit as part of the deal.

Is giving away equity the only option?

In short, no. We work on a shared risk / shared reward model. This means that we’re flexible enough to work on a financial model that works for your business.

This can take the form of equity, revenue share, convertible notes or a range of other remuneration structures designed to ensure we’re aligned in our efforts working towards a shared end-goal.

Contact us to discuss how we can work together to accelerate the growth of your start-up.

“Makk has been a truly excellent partner in such a vital growth phase for the company. They have provided us with some great industry knowledge as well as hands on assistance in transforming our marketing components in preparation for our “post-fundraise” growth phase. They are not just your regular agency, we see them as part of our team, and it has been a pleasure to grow alongside them.”

Liam Gerada, Co-Founder, Krepling

“We worked with Makk to review and audit our growth strategy. As a startup, poised for growth, it was extremely valuable to have the team’s wealth of expertise challenge our assumptions and provide constructive, and most importantly actionable feedback.”

Aaron Shaw, Co-Founder, Ember

“We worked with Makk to develop a go-to-market and launch strategy. Makk’s structured approach and rapid grasp of our market and technology made working with the team a joy – together we were able to deliver a plan that will help us reach our revenue and investment targets for the next 12 months and beyond.”

Sam Gillingham, Marketing Director, VoiceIQ

Make something happen

We’d love to hear about your business and to tell you more about how we can help you to grow it. We don’t waste time so we’ll be back in touch quickly.